New Fed Funds Rate: 4.00% – 4.25%.

Fed Funds Rate: The interest rate banks pay to borrow from each other overnight.

Does this impact mortgage rates too?

No.

But it impacts other things! Like, the yield on savings accounts! You may have received an email like this one…

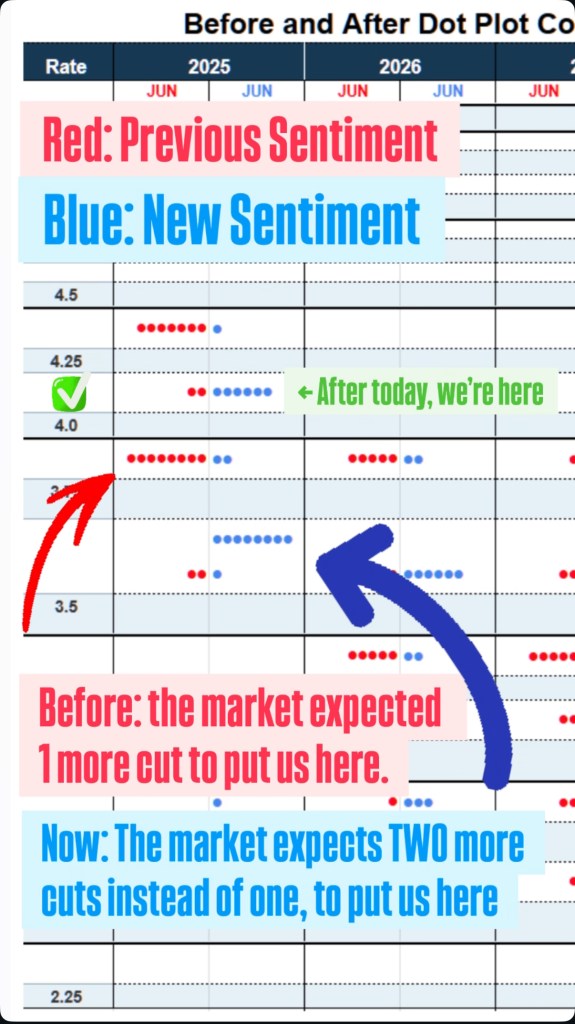

However… the market does like the IDEA of cuts…

So when the dot plot was released – a visual of how many rate cuts the fed chairs are expecting – oh, we partied.

We partied…

For all of 30 minutes.

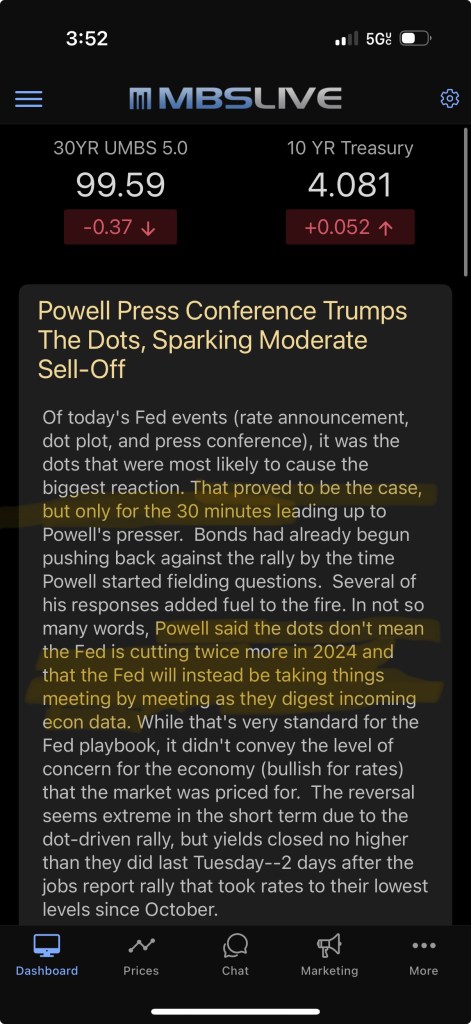

Then the Fed Press Conference began.

Prior to Jerome Powell taking the microphone, we were up 27 basis points on the day.

The market was LOVING the fact that the dot plot hinted at the Fed doing 2 more rate cuts this year, as opposed to just 1 more as previously thought…

Then it all went away.

It went away when Powell stated that: “the Dot Plot was in no way a promise to cut rates two more times.”

Instead, it was just an idea, that would have to be supported by incoming data.

What Happened Next?

A complete reversal.

From 27 bps in the positive…

To 37 bps in the negative…

This means we had to swing 57 basis points in the opposite direction to end up where we did – which is absolutely MASSIVE.

However…

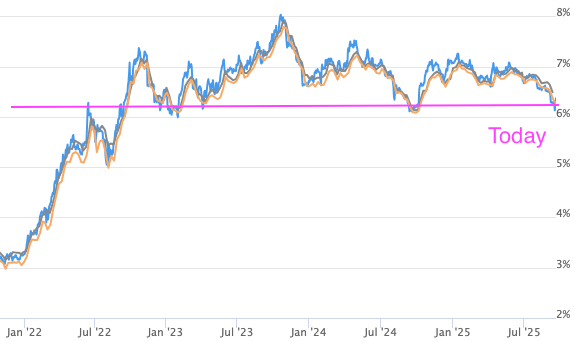

We are still sitting at some of the best levels of the year.

We hoped this rate cut would keep the momentum going…

…But it has simply proven to be a small speed bump – not necessarily a whole new direction.

“What Should I Do Now? Wait or Act?”

Well… Let’s consider this:

The LONG-ANTICIPATED rate cut came and went.

It was a bad day.

Want to wait for the next one..?

Rates are at the lowest levels they’ve been over the last 2.5 years…

If you buy or refinance today: You look like a GENIUS compared to 90% of people who bought since 2023.

If I had a 7%+ interest rate right now, I would refinance so fast…

And if I was in the market to buy a home, I’d try my hardest to lock something in now, with as many seller credits as possible, and try to lock a low 6% conventional, or high 5% FHA.

We Wait For More Data… 🔮

Want lower rates? Then we need:

-More weak jobs numbers.

-Low Inflation readings.

-High demand for US Treasuries

-More optimism from the Fed.

I’ll keep you in the loop as things come in. Never hesitate to reach out for a quick market pulse check.

Talk soon,

Ryan Zamudio | Mortgage Advisor

NMLS: 1973419

480.356.2772 | Ryan@BuyThatAZHome.com

Did you find this helpful?

I’d love your feedback. Shoot me an email if there’s anything else you’d like to see, and as always, I will aim to deliver only the most relevant information I find, and present it in as easy-to-read a fashion as possible.

Leave a comment